As ever when looking at oil services stocks like Halliburton $HAL and Baker Hughes $BHI , your long-term outlook will be defined by your view on the future of

oil prices. While this rule still applies, there are also many changing

trends within the oil services market, which Baker Hughes has positioned

itself to benefit from. If you are bullish on oil, then Baker Hughes

looks particularly well placed.

A bifurcated market in oil services

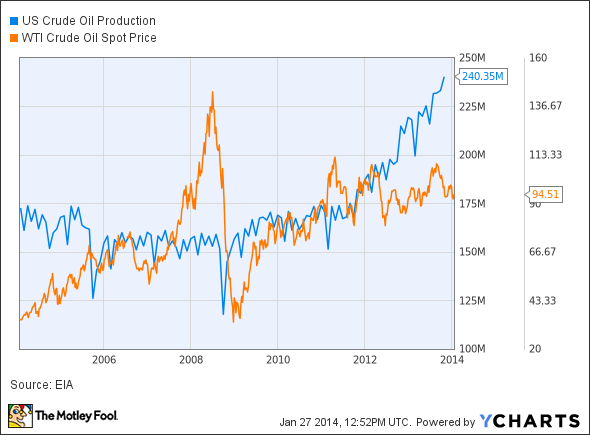

The biggest story in oil production in recent history is the wide-scale adoption of fracking technology in energy production in the U.S. -- the result of which has been the reversal of a seemingly inevitable decline in U.S. crude oil production.

The biggest story in oil production in recent history is the wide-scale adoption of fracking technology in energy production in the U.S. -- the result of which has been the reversal of a seemingly inevitable decline in U.S. crude oil production.

US Crude Oil Production data by YCharts

The good news for the oil services companies is

that production has gone up over the last two years, but the bad news is

that oil prices have been relatively flat. Moreover, the most wildly

followed barometer of the U.S. oil and gas services industry (rotary rig

counts) has been in decline over the last couple of years.

WTI Crude Oil Spot Price data by YCharts

All told, the result has been to bifurcate the

global oil services market into good growth in emerging markets versus

weaker growth in the U.S. Moreover, if oil prices fall then some current

U.S. production will prove commercially unviable.

What the industry is saying

Indeed, some of the underlying issues were touched on in General Electric's $GE recent conference call. When questioned by an analyst on the outlook for GE's oil and gas segment, CEO Jeff Immelt articulated the bifurcation in oil and gas services prospects between North America and the rest of the globe:

Indeed, some of the underlying issues were touched on in General Electric's $GE recent conference call. When questioned by an analyst on the outlook for GE's oil and gas segment, CEO Jeff Immelt articulated the bifurcation in oil and gas services prospects between North America and the rest of the globe:

"If you look at the national oil companies versus the integrated oil companies, our view is that the NOCs really haven't backed off at all...the place that we still think is reasonably weak is maybe around North America, some of the drilling and surface stuff"

It was a similar story from Halliburton. Its North

American revenue declined 4.9% in 2013, while outside of North America

its revenue increased 13.5%. Halliburton's management sees the current

North American market as "driven by increased drilling and completion

efficiencies with a relatively flat overall rig count and industry

overcapacity."

Putting these elements together, a picture is

emerging of a bifurcated market that is seeing U.S. oil services

companies being challenged in their core domestic market. In addition,

North American subsea/deepwater operations are outperforming vertical

onshore drilling. Meanwhile, increased usage of fracking has enhanced

productivity, which further contributes to overcapacity in North

America.

How Baker Hughes is adjusting

Baker Hughes' last earnings report was quite impressive, not least because it highlights the adjustments that the company is making to deal with changing conditions. There are four key factors:

Baker Hughes' last earnings report was quite impressive, not least because it highlights the adjustments that the company is making to deal with changing conditions. There are four key factors:

- Baker Hughes' share of total pre-tax profits from North America was only 43.7% in 2013. Latin America was weak, but the other segments (Europe/Africa/Russia, Middle East/Asia Pacific, and industrial services) saw pre-tax profits grow 14.9%

- Its North American pressure pumping business (heavily reliant on fracking activity) is seeing improved profit margins as the company takes action to overhaul the business in response to overcapacity

- The company sees itself as a deepwater specialist, a sector that is outperforming most of the oil industry

- Management has taken impressive measures to decrease working capital and increase cash conversion, the result being a record $1.5 billion in free cash flow

Where next for Baker Hughes?

Looking ahead, Baker Hughes' management sees the U.S. onshore rig count as being "essentially flat," while Halliburton expects a modest increase. However, recall that Baker Hughes is taking measures to improve margins, and its forecast for the onshore well count is for a 5% increase. In addition, U.S. offshore rig count is expected to increase 5%. Conditions appear to be getting better.

Looking ahead, Baker Hughes' management sees the U.S. onshore rig count as being "essentially flat," while Halliburton expects a modest increase. However, recall that Baker Hughes is taking measures to improve margins, and its forecast for the onshore well count is for a 5% increase. In addition, U.S. offshore rig count is expected to increase 5%. Conditions appear to be getting better.

Meanwhile, its international operations are

forecast to receive a boost due to an estimated 10% increase in the

international rig count. Add in the improved operational efficiencies

and increased cash flow generation, and the stock is starting to look

attractive. In fact, analysts have it on a forward P/E ratio of less

than 14 times earnings, as I write. If you are bullish on the outlook

for oil, then Baker Hughes is well worth looking at for 2014.

No comments:

Post a Comment