There are two key conclusions to be drawn from International Business Machines' (NYSE: IBM )

recent results. First, for the third quarter running, they were

disappointing, and second, the stock is still cheap. Growth-oriented

investors probably won't be turned on by such considerations, but

value-based speculators may see IBM as too good to pass up.

IBM disappoints, but reaffirms targets

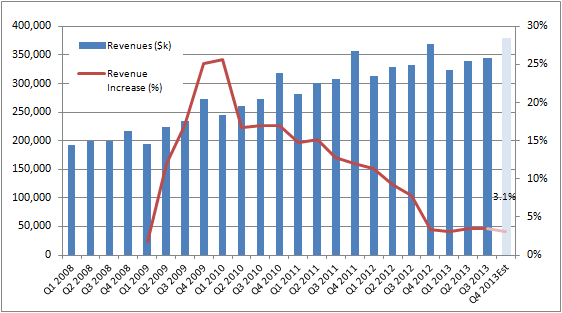

To put these results in context, here is a graph of its major business segments.

To put these results in context, here is a graph of its major business segments.

Source: company accounts.

Clearly, the last six quarters have been difficult

for revenue growth. However, it is understandable because IBM's focus

has been on exiting lower-margin businesses and focusing on reshaping

the business toward higher-margin software and services sales. Moreover,

its stated aim is to hit $16.90 in non-GAAP adjusted EPS for 2013, and

ultimately hit $20 in EPS by 2015. Eagle-eyed readers will note that

these earnings would put IBM on P/E of 10.2 and 8.8 times its 2013 and

2015 forecasts, respectively. Since management reinstated these targets,

should investors just ignore the falling revenue and buy a cheap stock?

Believing the numbers

Ultimately, your decision will boil down to how much you believe in the numbers. The latest evidence suggests that the underlying picture is getting murky.

Ultimately, your decision will boil down to how much you believe in the numbers. The latest evidence suggests that the underlying picture is getting murky.

- Diluted EPS rose 10.5% in the quarter, but pre-tax income actually fell 5.2%. The difference is due to a large reduction in the tax rate.

- Buybacks played a part, too. If you assume that the tax rate and share count remained constant, IBM's EPS actually fell 5.2% for the quarter.

- Last quarter, IBM predicted low single-digit growth for its global technology services, or GTS, but they came in at -1% on constant currency basis.

- Last quarter's weakness in the BRICs continued, with Chinese sales down 22% (with hardware sales falling 40%) and they are not expected to grow again until the first quarter of 2014.

- The weakness in software continues, with sales up just 2% in constant currency. Indeed, last quarter's strength was arguably due to rollover deals that were delayed from the first quarter.

In fact, the only segment that really performed

well was its global business services segment, or GBS, which delivered

constant currency sales growth of 5%. This was in-line with IBM's

forecast of mid single-digit growth.

All told, this was a weak quarter for IBM. In common with its major rival, Oracle (NYSE: ORCL )

, IBM reported good growth in business analytics (up 8% year-to-date)

and proudly trumpeted that it delivered $1 billion of cloud revenue in

the quarter.However, cloud revenue only represents 4.2% of total sales,

and the strength in business analytics highlights the fact that there is

growth in IT spending, just not in the areas where IBM gets most of its

revenue.Trends in software spending clearly favor software as a service

companies like Salesforce.com (NYSE: CRM ) .

Comparing IBM with Oracle

The analogy with Oracle is a strong one. Both are highly cash-generative tech giants with cheap valuations. Both are facing some structural challenges to their hardware offerings due to an increasing willingness among firms to outsource technology infrastructure to the cloud. As usage of software as a service, or SaaS, increases, hardware margins could come under pressure for IBM and Oracle because corporations will not need to buy hardware systems to run their on-premise on-license software. In their defense, IBM and Oracle are trying to migrate toward cloud-based solutions, but it's going to take time to work through the pressures on their existing sales.

The analogy with Oracle is a strong one. Both are highly cash-generative tech giants with cheap valuations. Both are facing some structural challenges to their hardware offerings due to an increasing willingness among firms to outsource technology infrastructure to the cloud. As usage of software as a service, or SaaS, increases, hardware margins could come under pressure for IBM and Oracle because corporations will not need to buy hardware systems to run their on-premise on-license software. In their defense, IBM and Oracle are trying to migrate toward cloud-based solutions, but it's going to take time to work through the pressures on their existing sales.

However, there is one key difference between the

two companies. IBM has set its stall out to achieve the $20 EPS target

in 2015, while Oracle has much more flexibility to adjust to changing

market conditions. It's good for IBM to laud the $8 billion it used to

make buybacks (and there is still $5.6 billion remaining in buyback

authorization), but investors surely wouldn't want the company to rack

up debt just to hit the $20 EPS target. Moreover, IBM may be using

resources that it could instead use to make strategic investments in

growth opportunities.

How the Salesforce.com deal demonstrates Oracle's flexibility

IBM's net debt stands at nearly $27 billion (14.3% of its market cap), while Oracle has $15.2 billion (10.1% of its market cap) in net cash and liquid instruments. Simply put, Oracle is in a better financial position to make the kind of game-changing acquisitions that can help accelerate SaaS-based growth.

IBM's net debt stands at nearly $27 billion (14.3% of its market cap), while Oracle has $15.2 billion (10.1% of its market cap) in net cash and liquid instruments. Simply put, Oracle is in a better financial position to make the kind of game-changing acquisitions that can help accelerate SaaS-based growth.

Moreover, with its recent strategic partnership

with Salesforce.com, Oracle is demonstrating its willingness to work

with a former rival. With Oracle now integrating Salesforce.com into its

infrastructure, its mutual customers should benefit from being able to

use Oracle infrastructure to run Salesforce.com's CRM applications,

while also using Oracle's financial and HR applications. The deal should

provide synergy for both companies.

The bottom line

Cost-cutting, buybacks, and foregoing revenue growth at the expense of profit growth are noteworthy. However, IBM is going to need a couple of solid quarters in order to convince the market that its long-term earnings objectives aren't affecting the way it reacts to changing market conditions. This is the third quarter in a row in which IBM has given disappointing results, and the company is running out of excuses.