Those of you old enough to be investing before the

year 2000 will recall that there there was another recession in the last

decade or so. Many investors have forgotten about the technology boom

and bust that occurred at the start of the last decade. However, in

certain sectors like telecommunications and Internet infrastructure, the

scars still run deep. Indeed, stock prices of data center providers

like Equinix (NASDAQ: EQIX ) , InterXion (NYSE: INXN ) , and the U.K.'s Telecity

are all down in 2013, largely because of fears of the sort of

overcapacity that plagued the economy after the tech bust. Are the

concerns justified? Is now a time to buy?

As is always the case in investing, the answer is yes, and also no.

Why it's a "no"

Economics 101 will tell you that most industries follow a pretty familiar path. High profits in an industry tend to encourage new entrants (or in this case, encourage existing providers to invest in new data centers), and capacity increases as everyone enjoys profits. After the initial profit euphoria, history tells us that firms tend to over-invest, only to then see profitability fall as too much supply is on tap. Indeed, all the leading players have been aggressively expanding data center capacity in recent years.

Of course, the problem for investors comes when

profitability starts to fall in anticipation of tougher conditions.

Analysts start downgrading their price targets, and suddenly the roof

caves in on your stock. Everyone then realizes that end-demand was

vastly overestimated. All of this happened in 2000 with Internet

infrastructure darlings like Cisco Systems (NASDAQ: CSCO ) and Alcatel-Lucent. The fallout was painful.

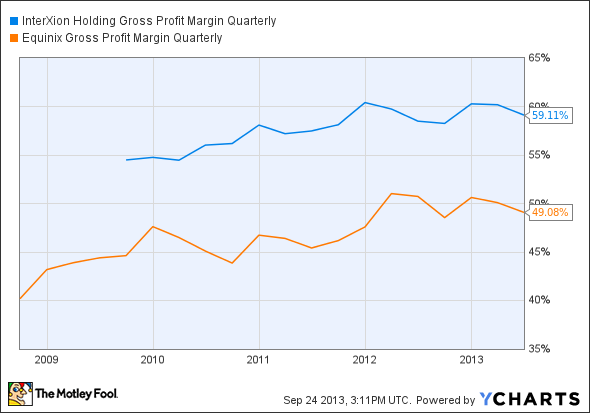

Fast-forward to today and there are signs that the

data-center providers may be facing overcapacity issues. The single best

indicator is probably gross margin. Decline is an indication of a drop

in pricing power, while an increase represents the contrary.

Gross margins look like they are moderating for InterXion and Equinix. Furthermore, Telecity

saw its gross margin decline in the first half from 57.3% last year to

56.9% this year. Telecity's revenue per occupied square meter increased

only 2.1%, which suggests that future revenue increases will come from

capacity expansion rather than pricing.

Turning to Equinix, it reduced its forecast for

second-half revenue growth, partly because it saw softer conditions in

Germany, longer sales cycles within its enterprise markets, and its

average deal size appears to be getting smaller. All three are signs of

slower growth.

InterXion gave results in August, stating:

Customers continue to have extended decision-making time frames, but demand remains healthy and the pricing environment is consistent with previous quarters, as is the sales pipeline.

Again, when sales cycles get longer, it is usually a

sign of a slowing market. If pricing is consistent, it implies the

industry players are finding it harder to increase them.

Why it's a "yes"

This isn't the late 90s. It really is different this time around because long-term demand looks much better-placed.

Internet-enabled devices -- smartphones, tablets,

etc. -- simply weren't available back then in order to drive demand for

all the network capacity that had been built up. It's a different story

now. AT&T and Verizon are both

seeing strong smartphone subscriber growth, and Intel has had to take

substantive action to change its business, thanks to the shift to mobile

devices.

It's a similar story with corporate demand for

cloud computing, and software as a service (SaaS) applications. All of

which is leading to demand for data centers to store information and

applications for corporation. Moreover, financial services firms are not

displaying any slowdown in their desire to use increasingly complex

trading systems.

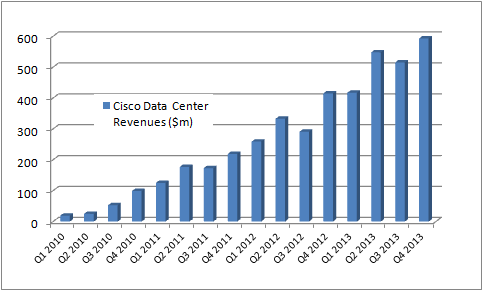

Data center demand remains high as evidenced by Cisco's revenues.

source: company accounts

Where next for Equinix?

In conclusion, end demand does appear to be slowing, and analysts/investors are starting to downgrade expectations. However, this is arguably reflected in Equinix's share prices right now. The key valuation metric -- as defined by Equinix -- is the 'adjusted discretionary free cash-flow.' Roughly speaking, this is the free cash flow generated if you strip out the expansionary CapEx. In its last update, Equinix forecast this figure to be around $620 million to $640 million for 2013, which represents around 5.2% of its current enterprise value.

The valuation looks fair, but the stock carries the

normal risks inherent in industries that are facing short term risk. If

you are a cautiously minded investor, you might wait for a better entry

point to compensate for the risk that margins start to fall.

Alternatively, you could monitor gross margins, and industry pricing

power in order to gauge when the demand has caught up with capacity.

No comments:

Post a Comment