IT security company Check Point Software's (NASDAQ: CHKP )

latest results confirmed a return to form, thanks to its product sales

growth finally turning positive after three quarters of declines.

However, they also highlighted how competitive its end markets are. With

its revenue growth having slowed to low-single digits, this company is

now firmly in the mature cash-cow phase of its evolution. Is there a

case to be made for buying the stock?

Check Point maturing in a tough market

The IT security market has unquestionably gotten tougher over the last few years. As the incumbent leader in the market, Check Point has had to deal with encroaching competition from the likes of Palo Alto Networks (NYSE: PANW ) and Fortinet (NASDAQ: FTNT ) . Palo Alto, a company founded by an ex-Check Point employee, has stepped up competition with Check Point in the high-end firewall market. Meanwhile, Fortinet, a company whose traditional strength lies in the small and medium-sized business market, has been successful in increasing its deal size as it becomes increasingly relevant to larger corporations.

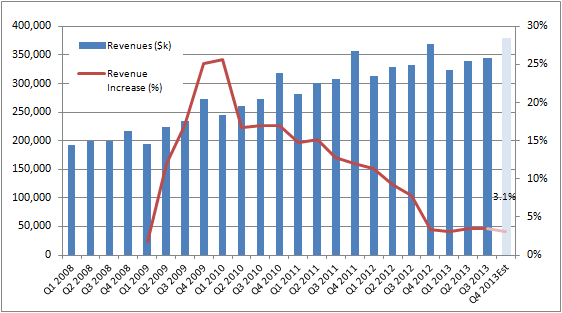

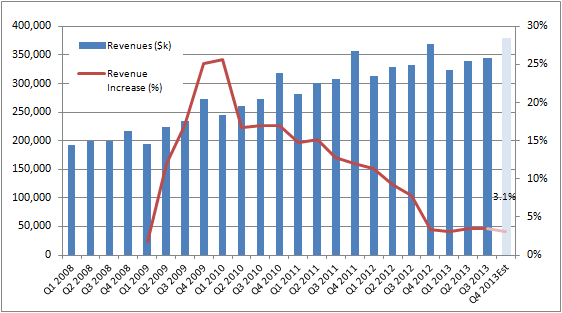

Consequently, Check Point has been squeezed at both ends, and its growth has slowed accordingly. The latest third-quarter results saw revenue growth at just 3.5% and the guidance for fourth-quarter revenues of $365 million to $395 million implies growth of just 3.1% at the mid-point.

Source: company accounts

5 reasons to be optimistic

A tech stock with low revenue growth isn't usually seen as an attractive proposition by the market. However, in Check Point's case there are four key positives from its third-quarter report.

First, product growth finally turned positive again.

Source: company accounts

Even though Check Point tends to bundle its software blades with its hardware products (so the hardware/software split is somewhat inexact), the return to product sales growth is still a good indicator because it suggests the installed base is increasing. In other words, Check Point should be able to sell add-on software blades in future to its new hardware customers.

Second, the company has successfully opened up new markets. Its new low-end 600 and 1100 series (aimed at the SMB market where Fortinet is strong) saw sales grow 40%. In addition, its high-end data center based sales (the 13500 and 21000 series) performed extremely well this quarter with healthy growth.

Third, its underlying metrics have improved. When Check Point takes a customer on board it books revenues for the products, and also bills for the full service contract. The service revenues are then recognized incrementally as the work is done. Therefore, investors should look at revenues and the change in deferred revenues to better gauge how it is performing.

For the first time in a year this metric turned positive.

Source: company accounts, and author's analysis

The final point is that its guidance of $365 million to $395 million looks a little conservative. At the mid-point it represents just 10.4% sequential growth when the last five years have averaged 13.7% sequential growth.

Where next for Check Point Software?

Palo Alto Networks gave results in September and they also confirmed that the security market remained healthy by predicting that next quarter's growth would be 37% to 42% on a yearly basis. Meanwhile, analysts have Check Point on low to mid-single digit revenue growth rates for the next few years, with EPS growing around 7.3% next year.

By my calculations Check Point has just generated $925 million in free cash flow (representing around 9% of its enterprise value) and this holds the key to its future. With over $1.2 billion in net cash , it has plenty of options in terms of initiating return cash to shareholders (dividends or more buybacks) or making growth enhancing acquisitions or investments. I suspect that with any of these initiatives in place, the stock will be rerated. However, it's one thing to hope something will happen, and it's another to see it.

In conclusion, Check Point looks undervalued and its underlying trading performance has improved, but you get the feeling its management could do more.

Check Point maturing in a tough market

The IT security market has unquestionably gotten tougher over the last few years. As the incumbent leader in the market, Check Point has had to deal with encroaching competition from the likes of Palo Alto Networks (NYSE: PANW ) and Fortinet (NASDAQ: FTNT ) . Palo Alto, a company founded by an ex-Check Point employee, has stepped up competition with Check Point in the high-end firewall market. Meanwhile, Fortinet, a company whose traditional strength lies in the small and medium-sized business market, has been successful in increasing its deal size as it becomes increasingly relevant to larger corporations.

Consequently, Check Point has been squeezed at both ends, and its growth has slowed accordingly. The latest third-quarter results saw revenue growth at just 3.5% and the guidance for fourth-quarter revenues of $365 million to $395 million implies growth of just 3.1% at the mid-point.

Source: company accounts

5 reasons to be optimistic

A tech stock with low revenue growth isn't usually seen as an attractive proposition by the market. However, in Check Point's case there are four key positives from its third-quarter report.

First, product growth finally turned positive again.

Source: company accounts

Even though Check Point tends to bundle its software blades with its hardware products (so the hardware/software split is somewhat inexact), the return to product sales growth is still a good indicator because it suggests the installed base is increasing. In other words, Check Point should be able to sell add-on software blades in future to its new hardware customers.

Second, the company has successfully opened up new markets. Its new low-end 600 and 1100 series (aimed at the SMB market where Fortinet is strong) saw sales grow 40%. In addition, its high-end data center based sales (the 13500 and 21000 series) performed extremely well this quarter with healthy growth.

Third, its underlying metrics have improved. When Check Point takes a customer on board it books revenues for the products, and also bills for the full service contract. The service revenues are then recognized incrementally as the work is done. Therefore, investors should look at revenues and the change in deferred revenues to better gauge how it is performing.

For the first time in a year this metric turned positive.

Source: company accounts, and author's analysis

The final point is that its guidance of $365 million to $395 million looks a little conservative. At the mid-point it represents just 10.4% sequential growth when the last five years have averaged 13.7% sequential growth.

Where next for Check Point Software?

Palo Alto Networks gave results in September and they also confirmed that the security market remained healthy by predicting that next quarter's growth would be 37% to 42% on a yearly basis. Meanwhile, analysts have Check Point on low to mid-single digit revenue growth rates for the next few years, with EPS growing around 7.3% next year.

By my calculations Check Point has just generated $925 million in free cash flow (representing around 9% of its enterprise value) and this holds the key to its future. With over $1.2 billion in net cash , it has plenty of options in terms of initiating return cash to shareholders (dividends or more buybacks) or making growth enhancing acquisitions or investments. I suspect that with any of these initiatives in place, the stock will be rerated. However, it's one thing to hope something will happen, and it's another to see it.

In conclusion, Check Point looks undervalued and its underlying trading performance has improved, but you get the feeling its management could do more.

No comments:

Post a Comment